Three Questions About Business Interruption Coverage

When you think about purchasing business policy, you think about the protection it provides for a fire, windstorm or burglary. Insurance that covers the cost to repair a damaged storefront is one thing – but what about the other implications of closing your doors? Could your business financially weather the storm without that income from regular customers while you rebuild? This is why business interruption coverage (sometimes referred to as business income coverage or income protection coverage) is so important. Here are common questions about business interruption insurance:

1. What is business interruption coverage?

Business interruption coverage compensates you for lost income if your business is temporarily closed due to a covered loss under your business policy. Your insurance policy would pay for the loss of income you would experience due to a partial or total interruption.

The interruption coverage time period begins with the date of the loss to covered property and ends on the date when the covered property is repaired, rebuilt or replaced with reasonable speed and similar quality.

2. What does the business interruption insurance cover?

The business interruption insurance covers the revenue the business would have earned (based on your financial records), had the loss not occurred and helps cover other expenses that don’t stop, like utility bills, payroll, taxes and rent.

3. What if I need to temporarily re-locate my business?

Experiencing a business loss is stressful enough… but then there’s the added strain of temporarily relocating while you rebuild. What’s more, that could mean additional costs, including:

• Relocation expenses (like moving trucks) for temporary space to work out of

• Costs to equip and operate the temporary location

• Overtime pay to employees in order to get the temporary location up and running

With Business Interruption and Extra Expense Coverage, you can relax – your policy can pay for necessary extra expenses that it takes to help keep things running smoothly if you need to relocate your business due to a covered loss.

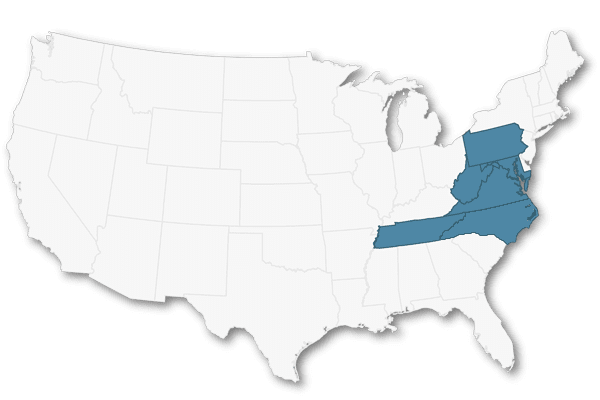

More questions? Contact Michele Maiden at Insurance Outfitters® in Shepherdstown, West Virginia.

Not sure if your business policy already has business interruption and extra expense coverage? Wondering how much it would cost to add it on?

Connect with Michele at Insurance Outfitters® in Shepherdstown, West Virginia, to find out. We can answer your questions and discuss how business interruption coverage would work if you experienced a covered loss.

Could your business financially weather the storm without income from regular customers? See how this important coverage can help.

Blog written by Jennifer Sonntag on November 26, 2018